BTCUSD TradingView: The Ultimate Guide for Crypto Traders

When it comes to cryptocurrency trading, BTCUSD (Bitcoin vs. US Dollar) is the pair that dominates charts, headlines, and traders’ minds. Whether you’re a seasoned investor or a curious beginner, having the right tools can make or break your trading strategy. One of the most popular platforms for analyzing BTCUSD is TradingView — a charting and social network platform for traders worldwide.

In this guide, we’ll break down what BTCUSD TradingView is, why it’s so important, and how you can use it effectively to make smarter trading decisions. We’ll also share some practical tips and chart analysis strategies you can use right away.

Understanding BTCUSD and Why It Matters

BTCUSD simply represents the trading pair of Bitcoin priced in US dollars. It’s one of the most liquid and actively traded markets in the world. Almost every crypto exchange lists BTCUSD because it serves as a reference point for the entire digital asset space.

The BTCUSD chart doesn’t just reflect Bitcoin’s value — it also shows market sentiment toward the broader crypto industry. When Bitcoin rises against the dollar, it often lifts other cryptocurrencies with it. Conversely, when BTCUSD drops, the rest of the market tends to follow. This “king of crypto” effect is why traders closely monitor BTCUSD, even if they don’t trade it directly.

Another reason BTCUSD is so crucial is that it’s heavily influenced by macroeconomic factors. Federal Reserve interest rate decisions, inflation data, and global financial events can all move the chart dramatically. This makes it an exciting — but volatile — pair for traders looking to profit from price swings.

Why TradingView is the Go-To Platform for BTCUSD Charts

If you’ve ever searched for a BTCUSD chart online, chances are you’ve ended up on TradingView. This platform has become the gold standard for technical analysis, offering a mix of powerful tools and a user-friendly interface.

TradingView allows traders to customize charts with hundreds of indicators, draw trendlines, apply Fibonacci retracements, and even use custom-built scripts for automated analysis. The real magic is that you can combine all these tools on a single, clean chart without needing to switch between multiple apps.

Another big advantage is social trading. TradingView has a massive community of traders who share their BTCUSD analyses, trade ideas, and even live charts. This makes it a learning hub for both beginners and experienced traders. You can literally watch someone else’s strategy in real time and decide whether to apply it to your own trades.

Setting Up Your BTCUSD TradingView Chart

When you first open a BTCUSD chart on TradingView, it might look a little overwhelming with all the possible tools and features. But setting it up to match your trading style is easier than you think.

First, decide on your timeframe. Day traders might prefer the 1-minute, 5-minute, or 15-minute charts to catch quick moves, while swing traders and investors may focus on the daily or weekly charts for long-term trends. Choosing the right timeframe is crucial because it determines how you interpret market noise versus meaningful price action.

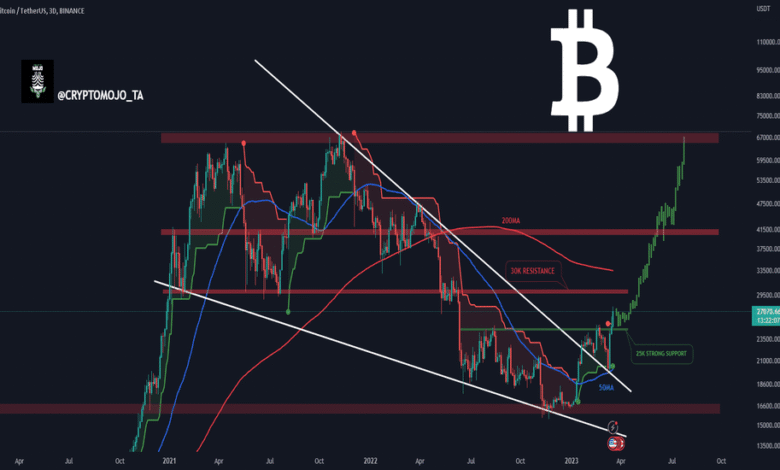

Next, add technical indicators that align with your strategy. Popular options for BTCUSD include the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and various moving averages (like the 50-day and 200-day). Keep it simple at first — too many indicators can clutter your chart and cause analysis paralysis.

Lastly, customize your chart style. TradingView allows you to switch between candlestick, bar, and line charts. Most crypto traders prefer candlestick charts because they provide more information about price action, such as open, high, low, and close values for each period.

Key Technical Analysis Tools for BTCUSD on TradingView

TradingView is loaded with analysis tools, but not all of them are necessary for every trader. The goal is to find what works for your BTCUSD strategy and master it.

One of the most popular tools is trendlines. Drawing a simple line connecting recent highs or lows can help you identify market direction and potential breakout points. Combining trendlines with volume analysis can reveal whether a move is strong or weak.

Another must-use tool is Fibonacci retracement levels. These levels often act as hidden support and resistance points, helping traders plan entry and exit points. Many BTCUSD traders swear by the 38.2%, 50%, and 61.8% retracement levels as critical decision zones.

For momentum-based strategies, indicators like RSI and MACD shine. RSI helps identify overbought or oversold conditions, while MACD shows trend direction and strength. Using them together can significantly improve the accuracy of your BTCUSD trades.

Combining TradingView Alerts with BTCUSD Strategies

One of TradingView’s most underrated features is its alert system. You can set alerts for price levels, indicator values, or even custom conditions. For BTCUSD traders, this is a game-changer because you don’t have to sit in front of your screen all day waiting for the right setup.

For example, if you’re waiting for Bitcoin to break above a key resistance level, you can set an alert to notify you via email, app notification, or even SMS. This allows you to focus on other tasks while TradingView does the monitoring.

Some traders take this further by combining alerts with automated trading bots that execute trades based on their TradingView alerts. This can be a powerful way to ensure you never miss an opportunity — though it requires careful testing before going live with real funds.

Common Mistakes to Avoid When Using BTCUSD TradingView

While TradingView is incredibly powerful, it’s not a magic crystal ball. Many beginners fall into common traps when analyzing BTCUSD.

One mistake is overloading the chart with indicators. More indicators don’t necessarily mean more accurate predictions. In fact, too many can cause conflicting signals, leading to confusion and hesitation.

Another pitfall is ignoring market fundamentals. While TradingView is focused on technical analysis, Bitcoin’s price can be heavily influenced by news events, regulatory changes, and macroeconomic shifts. A sudden announcement from the SEC or a major exchange hack can completely override your chart setup.

Lastly, avoid overtrading. The BTCUSD market is open 24/7, which can tempt traders into constantly taking positions. This often leads to burnout and unnecessary losses. Stick to your strategy and only trade when your criteria are met.

The Future of BTCUSD TradingView Analysis

As the cryptocurrency market matures, tools like TradingView will continue to evolve. We’re already seeing integrations with more exchanges, better real-time data feeds, and even AI-assisted analysis.

For BTCUSD traders, this means more opportunities to refine strategies and make data-driven decisions. Imagine having an AI-powered assistant that not only suggests trade setups but also explains the reasoning behind them — this is the direction TradingView and other platforms are heading.

However, no matter how advanced the tools become, the fundamentals of trading will remain the same: patience, discipline, and a clear strategy. TradingView can give you the best charts in the world, but it’s still up to you to pull the trigger.

Final Thoughts

BTCUSD on TradingView is more than just a chart — it’s a window into the heartbeat of the crypto market. Whether you’re scalping intraday moves or holding Bitcoin for the long run, TradingView gives you the flexibility and tools to execute your strategy with confidence.

The key is to start simple, learn the features that align with your style, and avoid the temptation to overcomplicate your analysis. Remember, the best traders don’t just rely on tools — they use them to complement a well-thought-out plan.

So, fire up that BTCUSD TradingView chart, apply your indicators, set your alerts, and trade with clarity. The crypto market is fast, volatile, and unpredictable — but with the right tools and mindset, you can navigate it like a pro.